Budget Questions Part 3

Take a minute to think about how you budget.

Me personally, I have a salaried job and so I know that I get paid every second friday. I also know that I have to pay for my housing on the first of each month. I know that my Mastercard is due on the 7th of each month and that my visa card is due on the 17 of each month. I also know that it is good to save for the future and so I make regular contributions to my RRSP, TFSA etc.

I graduated from university back in 2012 with nearly $50,000 in student debt which I paid off in 2019. I have bought and sold real estate over the years and I currently own a house in Corner Brook Newfoundland which is occupied by long term renters. I hope to sell this house during 2026.

My goal each month is to not spend more money than I bring in. Sometimes I don’t succeed at this and so I take money from my line of credit to cover my expenses and then I use my surplus from subsequent months to cover the costs of using my line of credit until it is back to zero.

By managing my finances, I live a predictable life. I know that I can maintain my day to day expenses and that I can splurge when I want to. I also know that I have the resources necessary to cover unexpected expenses, such as an unexpected vet bill or property maintenance issue. It is my job to ensure that I keep my finances sustainable.

So can we apply a similar management framework to the finances of the Municipality of North Cowichan?

I’d say, yes and no.

Council are responsible for setting the guidelines and guardrails for municipal financial management.

However, their ability to manage their budget is dependent in part on efforts of third party agencies, like BC Assessment who set the annual assessed rate for property in BC and the BC Municipalities base on the annual tax rate bylaws on these assessed values.

Specific to residential assessment rates, this January 2, 2026 News Release shows a municipality by municipality comparison of the typical residential property on Vancouver Island and compares how these values of changed between 2024 and 2025 depending on trends in the local real estate market.

According to this list, the typical single family home in North Cowichan was assessed at $727,000 in 2025 and is currently assessed at $733,000 in 2026 which represents a +1% change. Where the municipality in their Connect North Cowichan page continue to emphasize “tax rates per capita” I note that a recent staff report to be considered at the January 13, 2026 Council meeting confirms that this might be a misleading metric due to inconsistencies in the number of persons who occupy each home.

I have also blogged about how this seemingly preferred metric of per capital tax rates, lacks context because the ultimate value of relative tax rates depends on the number/quality/efficiency/satisfaction with municipal services offered. Wouldn’t you say?

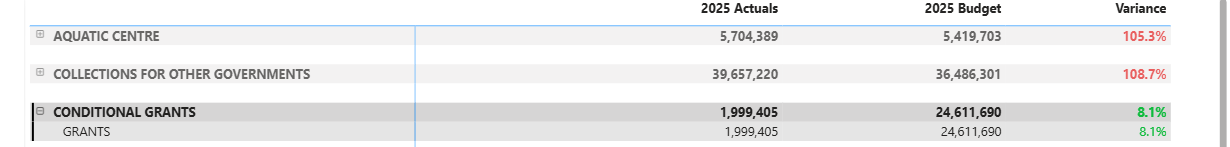

In addition to the major revenue source of taxes, the municipality collects various fees and charges (as set out in fees and charges bylaws) including annual costs for water and sewer utility services - which are set annual on a cost recovery basis. These fees and charges are collected in addition to water and sewer parcel taxes which appear to be set on a regional basics and are set out in a Parcel Tax rate bylaw.

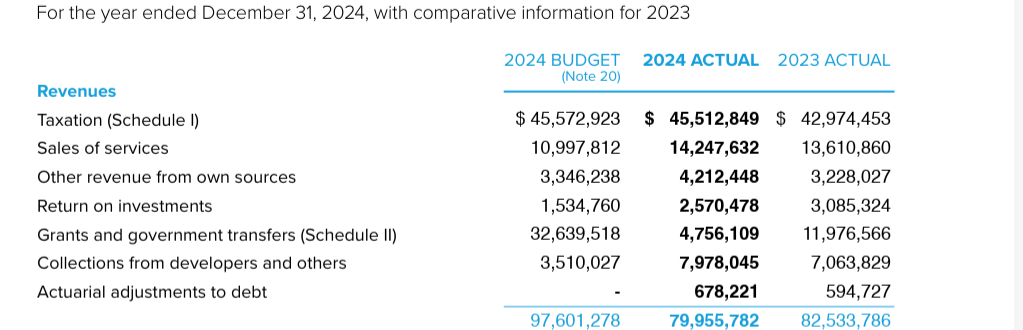

Two other major sources of revenue, as shown in the 2024 Annual report but which don’t appear to be represented in the most recent 5 year financial plan bylaw, are Grants and Government Transfer and Developer contributions.

My theory as to why this data is not included in the financial bylaw, is that if you look at the 2025 Budget dashboard, you will be see that the Municipality has currently only received 8% of the grant monies they have budgeted.

a screenshot from the municipal budget dashboard showing current rates of actual spending against budgeted

So returning to my budgeting analogy, of how I manage my personal expenses with clarity on my predictable revenue and easily trackable spending, it seems like it is hard to control the revenue and expenses of a municipal budget because even if Council set specific guardrails or priorities, they rely on staff to do the anticipated work. However, the ability of staff to do this work depends on the ability of Council to remain focused on determined plans since budgets are based on these same plans.

Which is to say, if and when a majority of Council “shakes it up” and starts running in various directions during the year, this prevents staff from working along their previously committed deliverables according to the prior years budgeted plans and priorities. A tangible example of this Council seeming to stray away from established business plans, was obvious in the whole Municipal Forests debacle from last year as well as in the amount of time, effort, and resources required by staff to process municipal development requests such as the fast food corner on Henry Road in Chemainus, expansion of the urban containment boundary in the Bell McKinnon area and the Councillor Findley initiated distraction of the energy efficiency component of the municipal building bylaw.

Most problematic from an accountability perspective as I see it, is the irony of the majority block on on Council currently, is that they seem to pride themselves on being fiscal conservatives who only spend money that needs to be spent. And yet, all indications are that they have wasted so much time and effort and attention from the budget they previously committed to in 2025.

A screenshot of business plan links that were publicly disclosed at a Dec 10, 2024 Committee meeting that occurred in Chemainus

My theory on the wastage is that when you review the business plans from 2025, looking for instance at Engineering department plan, you’ll see that it does not contain specific trackable deliverables or associated budgets. And without this transparency, staff do not appear to be providing Council with the details the need to hold the municipality accountable for its spending.

This is problematic because as set out in the online budget dashboard, Mayor and Council approved nearly $173 million dollars in spending in 2025. A budget of this size requires careful management and careful management can only be accomplished when Mayor and Council both require transparency and are also transparent in their consumption and spending of annual revenues.

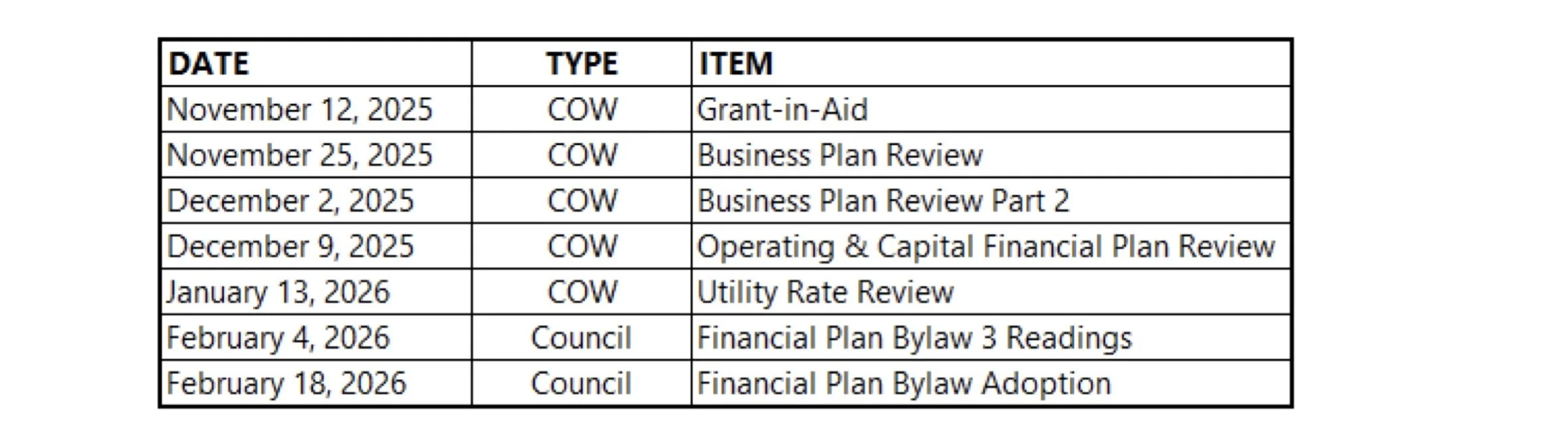

Related to the above, is my observation based on review of documents that are publicly available from the Municipality of North Cowichan regarding the 2026 budget, is that the Council only appears to be providing oversight on the difference in costs, and not the costs as a whole. I’ve come to this conclusion based on the numbers disclosed in the most recent 2026 Budget Update Staff report. They also appear to be significantly behind the timeline they set for themselves back in August 2025 when they set out the following schedule:

A recommended schedule from staff as provided in an August 12, 2025, committee report to Council

So returning to my analogy of the steps involved in managing my own personal budget, I would suggest that the majority of members on Council, the block as they are currently known, seem to disregard (or maybe lack awareness of) the purpose of municipal government. I say this because, I honestly believe that if they were more attuned to the needs of government has they’ve historically been defined, the majority block on council would remain focused on annual approved municipal budgets and the many guiding documents of municipal government such as the OCP.

But they don’t and they won’t and so what we need to do, is to elect new people to Council. I am happy to be one of them if you’ll have me. Thank you!