Interplay of Assessment and Taxes

The municipality creates a new tax rate bylaw every year. It is updated annually to ensure that the municipality can collect sufficient revenue to fund budgeted operations. More information is available on the Taxes section of their website.

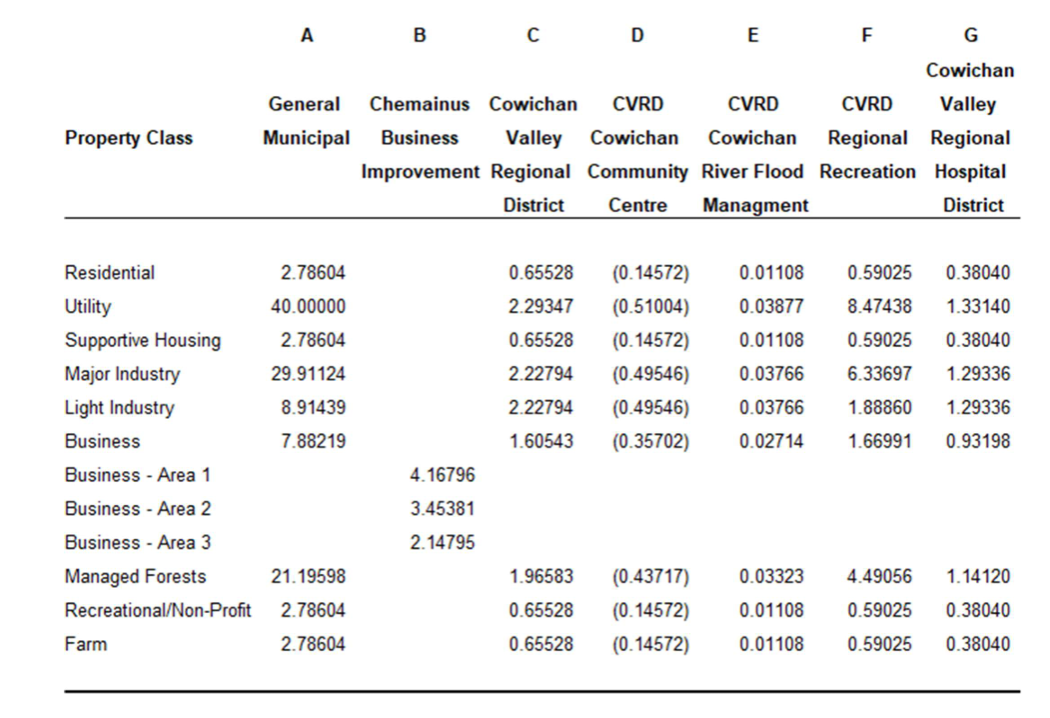

According to the 2025 Tax Rates bylaw, there are 7 categories of taxes that are collected including:

(a) North Cowichan general municipal purposes

(b) Chemainus Business Improvement Area

(c) Cowichan Valley Regional District

(d) Cowichan Valley Regional District's Cowichan Community Centre

(e) Cowichan Valley Regional District's Cowichan River Flood Management

(f) Cowichan Valley Regional District’s Regional Recreation

(g) Cowichan Valley Regional Hospital District - Column G

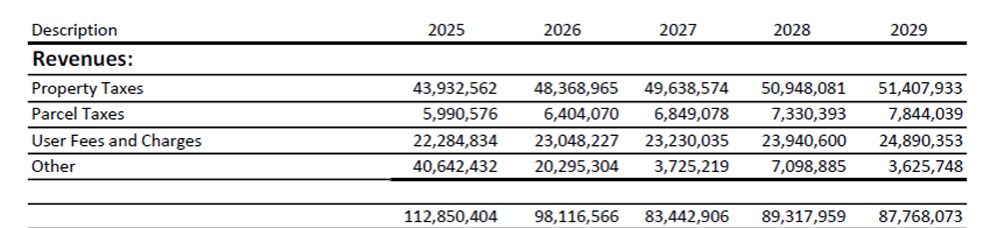

According to the recently amended 2025 5 year financial plan bylaw adopted by Council on December, they anticipate collecting the following revenue in 2025:

Unfortunately there will be a big hit to revenues in the 2025/2026 calendar year with the closure of the Crofton mill which the municipality has previously identified as the largest single taxpayer in North Cowichan. The municipality has created this webpage to summarize relevant developments.

Property Tax Exemptions

The municipality also maintains a permissive tax exemption program for various reasons with its purpose being that certain organizations are not required to pay property taxes even though property taxes are the municipality’s primary source of revenue.

The Permissive Tax Exemption Bylaw includes a list of the various 100+ organizations and land owners that are exempted from taxes.

Grant in Aid

A much smaller scale program offered by the municipality for other eligible organizations is their Annual Grant in Aid Program.